Boost team efficiency

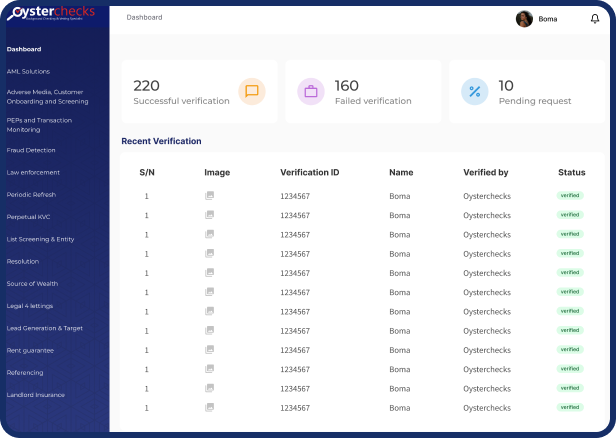

Use one tool to manage the whole process, with less false positives and easier case management

Safeguard your revenue

Detect signs of fraud in real-time. Data-driven approaches help you prevent money losses

Stay AML-compliant

Connect KYC, AML, and KYB verification with transaction monitoring to detect and report any suspicious activity

Get one solution that alerts you to all red flags

Sign Up

User Verification

AML Screening

Fraud Monitoring

Transactions

Login

Works where you work

Fintech

Meet regulatory requirements and stop all types of fraud, including payment/chargeback fraud. Monitor suspicious activity with a risk-scoring approach and easily report when it’s detected.

Banking

Ensure AML compliance to stop all fraud, including bank card theft. Use transaction monitoring to run bank card risk scoring for credit requests and thresholds checking

Gambling

Prevent promo and deposit abuse, as well as unfair chargebacks. Detect specific fraud patterns including multi-accounting, arbitrage betting, and affiliate fraud

Ecommerce

Stop payment fraud, including illegal chargebacks and credit card fraud. Also, your users are securely protected from account takeovers